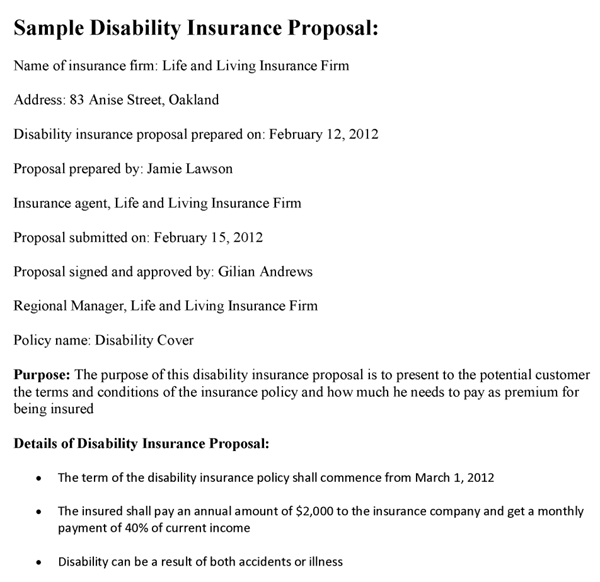

A disability insurance proposal is said to be document that is written by an insurance company and is presented to different prospective clients including individuals and companies. This insurance proposal describes in details the terms and conditions and other essential relevant information about the disability insurance policy. As a proposal is said to be a marketing tool that helps in fetching more and more business so in this case of an insurance company, business means the more and more policy holders. Therefore this insurance proposal is used to approach and attract the potential clients so that they can be convinced to purchase the insurance policy. As there are many insurance policies covering the different areas like auto insurance, home insurance, healthcare insurance etc, the disability insurance policy is related to disability of the policy holder.

Disability Insurance Application

The main purpose of buying this policy by an individual is that the insurance company offers the policy holder that he will continue receiving a set amount of income if unfortunately he suffers from any kind of disability due to any reason i.e. an illness or accident that will damage the ability of the person to work or even cause a permanent disability that means that he can never work at all. A disability insurance proposal must clearly mention the circumstances and situations under which the terms of the policy will be applicable. The amount or the set percentage of income that will be paid to the person in case of disability and the total amount of the premium to be paid by the policy holder must also be mentioned clearly to avoid any disputes in future.

Create your own Insurance Proposals by using the following template,