What is Insurance Proposal?

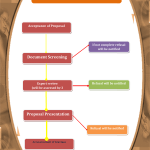

An insurance proposal letter is a document that is prepared and sent by an insurance firm or its agency to a potential client. That potential client many be any individual or a company. This proposal letter describes the benefits of a certain insurance policy or insurance cover for that potential client. Therefore this proposal letter should be persuasive yet very police and should be well written after giving much thought to it. Different insurance companies are offering different policies to different client through this proposal letter. It is considered to be a basic and most important document that is use to make a deal finalized between the insurance company and the client.

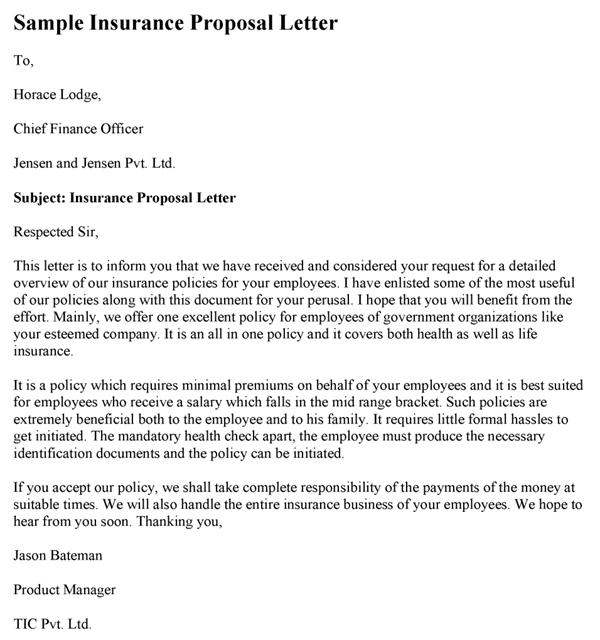

Sample Insurance Proposal Letter

This insurance letter conveys a solution to the clients who are facing different problems. It is just like floating an idea in shape of a solution to a client who is looking upon to have some insurance protection for his business against lawsuits of different customers or looking forward to provide some health benefits to its employees working for him. An insurance proposal letter generally included a number of insurance packages that are being offered by a specific insurance company to meet different requirements of a client. Some of the clients especially who are companies having a number of employees are generally looking for some packages of insurance products that are carrying certain benefits like dental coverage and other medical payoffs. Therefore, a well written and customized insurance proposal should directly match the immediate requirements of the client so that it can be approved without giving a second thought by the approving authorities.

Create your own Insurance Proposal Letter by using the following template,